CIBIL promoted by Transunion is the leading Credit Bureau in India while others such as Experian are still struggling to harness Consumer Database. CIBIL is continuously striving to deliver better customer experience, although albeit at a slower pace. We tried the CIBIL Online interface to fetch CIBIL Transunion Score and here is a detailed experience of ours.

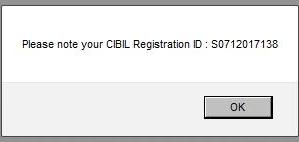

PAN card is a must for fetching CIBIL score online. Upon entering Consumer Details[Name, Address, Phone, etc] and Paying Rs 470 online we got a CIBIL Registration ID as shown below, [Step-1]

CIBIL Wants to Confirm Your Identity

CIBIL will ask a series of questions related to your loans and credit with Banks and Financial Institutions. Keep your past Loan Account Numbers, Credit Card Numbers etc handy because this is an online authentication process and the internet session will last for just few seconds.

Step-2:It asks you to tell them the list of all credit account types you have had as shown below.

Step-3: You will have to choose the list of Lenders with whom you have had Loan / Credit Accounts either in the past or active currently as shown below

Step-4: You will be asked to Match Lender(SBI, HDFC, etc) and the Account Type(Credit Card, Car Loan, etc) as shown below

Step-5 CIBIL offers you a choice of Lenders Vs last 4 Digits of Credit Card Number which you may have had or not as shown below [If you are a smart reader, the last 4 digits of my MasterCard is know to you]

Step-6: The system generated a question and asked it in Negative – Lenders where You have NEVER Applied for a Loan / Credit as shown below, thus READ EVERY Question Carefully

So what happens next ? Based on your response in the interactive session, CIBIL tries to verify your identity it will start from Matching your PAN card with Name and Address uploaded by member banks to its database until Step-6 of the Questionnaire. We were not successful the first time. Second time we kept all the records in front of us including previous Credit Reports and entered information as recorded in CIBIL, but CIBIL would now show our Transunion Score and instead displayed the message to Send Documents by Post / Speedpost.

Thus for now, we’ll strongly recommend consumers to Order your CIBIL Transunion Score / Credit Information Report using the form provided.

You can see Sample CIBIL Credit Report with Meaning of each term here.