What According to CIBIL is the meaning of “Credit Hungry Consumers” ?

India’s leading credit bureau, CIBIL which manages your credit history and credit score along with global leader Transunion has devised a word – Credit Hungry Behavior for Consumers who makes frequent loan applications [Personal Loan, Auto Loan, Credit Card, etc], as there will be a Credit Inquiry every time an application is made. This sends a negative signal for money lending institutions about the consumer credit profile. In such a case institutions who have already extended loan are likely to raise Interest Rates, Fees or EMI so as to secure their own funds.

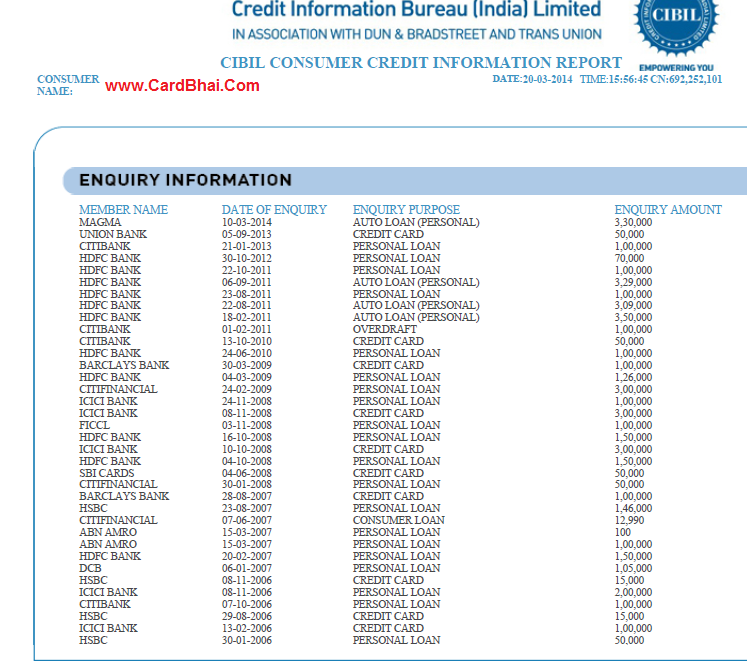

To Explain the same, have a look at the following,

In between 2006 and March-2014, this customer has 38 Credit Inquiries i.e 4.5 Enquiries Per Year, which is too much for an individual and negatively affects his score. If you look at some of the Enquiries above, they have happened simultaneously, which tells lenders about your spending habit and pattern from which they asses your credit profile.

In between 2006 and March-2014, this customer has 38 Credit Inquiries i.e 4.5 Enquiries Per Year, which is too much for an individual and negatively affects his score. If you look at some of the Enquiries above, they have happened simultaneously, which tells lenders about your spending habit and pattern from which they asses your credit profile.

What is the Ideal Number of Credit Enquiries an Individual Can Have on his Credit Information report ? Ideally, one must not have more than 2 Enquiries per year on an average. At unique times when you are availing Home Loan, which according to lenders is treated as one of Life Time Event, upto 3 or 4 Enquiries around the same time will not matter, provided you have gotten the Loan sanctioned & availed from one of them and there are no further Enquiries in that regard.

So now you know who a Credit Hungry Consumer is and how it negatively affects Credit Score . You must promise yourself that you will not avail more credit & rather try to boost savings & investments by investing in Mutual Funds.